The Precious Battle Against Money Laundering and Terrorism Financing

The Precious Battle Against Money Laundering and Terrorism Financing

Insight MinLaw goes behind the scenes to uncover stories about how the work we do impacts you.

At some point or another, you may have patronised a jewellery store in the heartlands or in a mall. But did you know that these dealers are regulated under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act? It is quite a mouthful, and a piece of landmark legislation that packs a punch.

We meet Evelyn Ang, Justin Tan and Hong Khim Woon from MinLaw’s Anti-Money Laundering / Countering the Financing of Terrorism Division (ACD) to find out more about their work, which forms part of Singapore’s larger efforts to counter money laundering and terrorism financing.

From left: Evelyn, Justin and Khim Woon

From left: Evelyn, Justin and Khim Woon

“Learning new things everyday” – this is how Khim Woon, a team leader in the Enforcement & Investigation Branch (EIB), describes his time at ACD.

When Khim Woon first joined MinLaw, the Precious Stones and Precious Metals (PSPM) industry was new to him. Prior to that, he only knew about diamonds from buying a wedding ring for his wife.

Khim Woon, team leader of the Enforcement and Investigation Branch (EIB) at ACD

Khim Woon, team leader of the Enforcement and Investigation Branch (EIB) at ACD

Nearly two years on, he is familiar with almost 2,000 dealers of various categories – from jade and sapphires to bullion trading – registered with ACD.

Khim Woon was formerly from the Council for Estate Agencies, where he was involved in the implementation of the anti-money laundering and countering the financing of terrorism (AML/CFT) regime for licenced estate agents and estate agencies. Today, he works with Evelyn and Justin’s teams – the Supervision and Compliance Branch (SCB) and Registration and Research Branch (RRB) respectively.

The three, who come from varied and diverse backgrounds, work together to protect the PSPM sector from criminals and nefarious entities.

More Than an Act

At the centre of their work lies the PSPM Act, which has been in force since April 2019. Previously, those in the PSPM sector were already required to file cash transaction reports and suspicious transaction reports since 2014.

Now, businesses dealing in precious stones, precious metals, and precious products must be registered and supervised by MinLaw.

This levels up trust and reputation of the sector – a common cause welcomed by the industry associations.

Mr Reuben Khafi, President of the Diamond Exchange of Singapore, said: “The introduction of the PSPM Act in 2019 was a timely move that will go a long way to maintain and protect the good reputation of Singapore as a compliant and internationally recognised diamond and jewellery centre.”

“I strongly believe that to safeguard Singapore against money laundering and terrorism financing activities, all regulated dealers play a pivotal role in achieving synergistic outcomes,” added Mr Ho Nai Chuen, President of the Singapore Jewellers Association.

Consumers thus have the added confidence that there is lower risk in them transacting with businesses which could be entangled with criminal or terrorist activities.

Whole-of-Government Effort

ACD also leads the Precious Stones and Precious Metals Dealers workgroup comprising various government agencies to enhance their understanding with regards to the sector, and promote coordinated solutions.

This collective effort is critical as precious stones and precious metals are an easy target for criminals to launder money. They are portable, valuable and easily convertible to cash, said Evelyn, who has had close to a decade’s experience in a homegrown jewellery retailer.

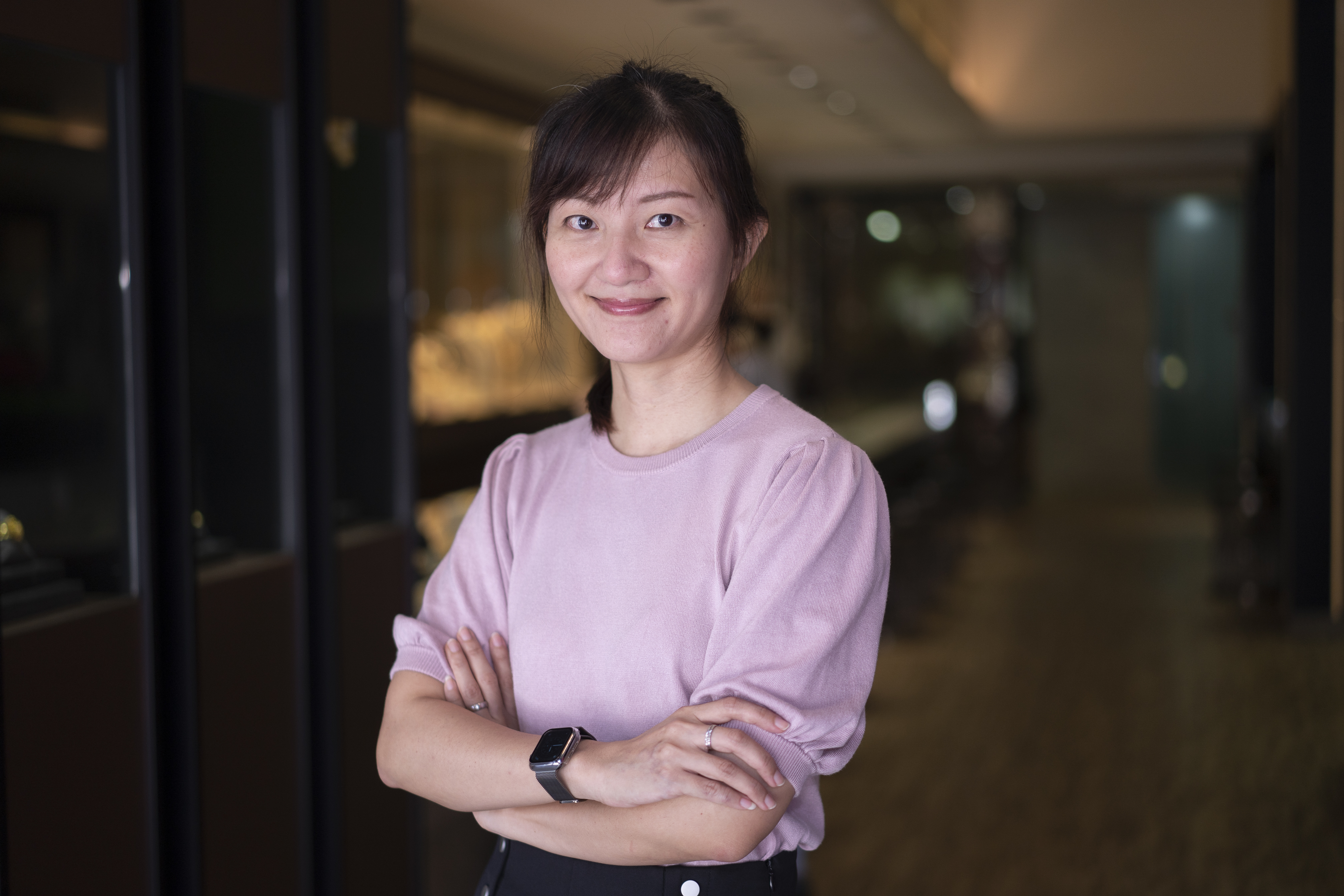

Evelyn, team leader of the Supervision and Compliance Branch (SCB) at ACD

Evelyn, team leader of the Supervision and Compliance Branch (SCB) at ACD

Starting From Scratch

When the Act was first implemented, getting the show on the road was not straightforward.

For starters, there were no registered dealers, and Justin’s team had to start from scratch by looking at various government databases to sieve through thousands of data entries.

This was done to determine which business entities potentially fell under the PSPM Act, and if they had to consider registering themselves with ACD. Although this was tedious, his past experience working as a senior analyst at both the Singapore Customs and the Singapore Police Force came in handy.

Justin, team leader of the Registration and Research Branch (RRB) at ACD

Justin, team leader of the Registration and Research Branch (RRB) at ACD

Back then, registered dealers were also largely unaware of the potential money laundering and terrorism financing risks to their industry.

“When the Act was first announced, there was some hesitation from our members for the need to be licensed and further regulated,” said Mr Khafi.

This was a task for Evelyn’s team to tackle. It was not without difficulty as the sector is diverse, comprising large players like international brands to small outfits like home-based business owners and wholesalers situated in nondescript industrial buildings. Also, not all dealers are conversant in English.

SCB had to ensure that all dealers, regardless of size and operations, would be able to implement the necessary measures.

“To do this, we engaged the industry associations and dealers to better understand their constraints. We took into consideration how best to ensure their compliance with the law, while keeping it business friendly and practical,” Evelyn said.

SCB is also involved in the inspection of regulated dealers to ensure compliance to the Act and leads the outreach and capability development efforts for the sector.

In terms of desktop surveillance and intelligence assessment to identify scenarios or entities that may pose potential money laundering and terrorism financing risks, RRB faces the uphill task of sifting through morasses of qualitative and quantitative data to connect the dots, and risk-assess what needs to be acted on.

Justin shared that it takes domain knowledge and experience to be able to do this – machines are still not fully able to replicate the human touch to ascertain more abstruse nuances in the data field and conduct sense-making.

The information from desktop surveillance and intelligence assessments is then passed on to Khim Woon’s team to conduct inquiry and enforcement checks.

From October 2019 to March 2021, this team carried out 284 enforcement checks and initiated investigations against 225 regulated dealers for a range of offences under the PSPM Act and its subsidiary legislation. Khim Woon noted that most of the time, dealers who were found not to comply with the regime were not aware of or did not fully comprehend the Act.

Action, Awareness and Appreciation

Despite the initial difficulties, the fruits of ACD’s labour are starting to show.

In the two years since the Act was implemented, close to 2,000 dealers - operating more than 2,500 outlets – have registered with ACD.

“We are already seeing increased awareness within the regulated dealers, who are more aware of the risks associated with money laundering and terrorism financing in the sector,” shared Khim Woon.

Industry associations appreciate the benefits of being a registered regulated dealer. Mr Albert Cheng, CEO of the Singapore Bullion Market Association, shared that they are able to weed out suspicious transactions and protect the industry from unscrupulous individuals or organisations.

“Our members appreciate that ACD conducts industry feedback and consultation prior to new implementation, and notice or grant period is often given before a change. On top of that, training, seminars and conferences are held on a periodic basis to refresh and retrain the dealers, which is important especially when there is a change or update,” he said.

A Precious Future to Protect

ACD remains ready to adapt to the ever-evolving needs of the industry and its stakeholders.

For instance, it recently amended the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Regulations (“PMLTF Regulations”) in response to dealers’ feedback that a more equitable fee payment scheme is needed to distinguish between the big and small industry players.

Among several changes, application fees for new entrants have been reduced from $140 to $120. In addition, registration is now on an annual basis and regulated dealers are no longer required to pay the renewal application fee as this is factored into the registration fee.

As part of its digital push, ACD is also launching a new e-portal later this year. Called myPal, it will function as a single touchpoint for PSPM dealers on registration, supervision, enforcement and investigation matters.

ACD officers are driven to ensure Singapore remains a prosperous trading hub for the PSPM market, without compromising on the nation’s AML/CFT efforts.

Evelyn said: “I am confident that the dealers will continue to grow in their knowledge and experience on this AML/CFT journey and be well prepared to protect their business from being used by criminals. The initial phase of getting everything in place is always the hardest. We will only grow stronger.”

Watch this video to find out how PSPMs could be used in money laundering and terrorism financing!

Last updated on 23 June 2021

Other stories you may like:

Protecting Your Right to Copyright

The Race to Give Singaporeans and Local Businesses a Lifeline